If you’ve ever tried to manage your salary, you’ve probably heard people say — “Just follow the 50:30:20 rule, it works for everyone!”

Sounds neat, right? Half for needs, some for wants, the rest for savings.

But if you’ve actually tried it in India, you already know — it’s not that simple.

The Rule Everyone Talks About

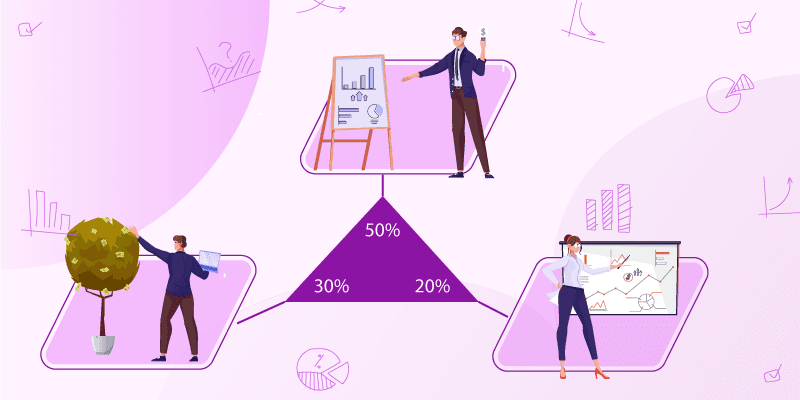

So, the idea goes like this:

- 50% of your income should go to needs — rent, groceries, EMIs, bills.

- 30% want — Netflix, food deliveries, trips, shopping.

- 20% to savings and investments — SIPs, insurance, emergency fund.

On paper, it makes sense.

In real life, it often falls apart.

Why It Feels Unreal for Indian Households

Let’s be real — our financial lives don’t look like Western countries.

For one, many of us support parents or pay school fees for kids.

Rent in cities like Mumbai or Bengaluru can easily eat up 40–50% of income.

Then there are weddings, medical costs, or helping a sibling — things you can’t just “budget out.”

So, when people ask, “Does the 50:30:20 rule work for Indian households?”

The honest answer is — not exactly, but you can tweak it.

How to Make It Work for You

Here’s what actually helps more than any fixed formula:

- Know where your money goes.

For one month, just track everything. You’ll be shocked how much goes into random spends. - Pay yourself first.

The moment your salary arrives, move a small part into savings or SIPs. Treat it like rent — non-negotiable. - Cover your basics smartly.

Health and life insurance are not “extra expenses.” They’re your safety net. - Tweak the ratio.

Maybe for you it’s 60:25:15 — and that’s fine. The point isn’t perfection; it’s consistency. - Review once a year.

As income and goals change, so should your money plan.

A Desi Twist That Actually Works

Most Indian families find 60:25:15 or even 65:20:15 more doable.

Because let’s face it — “needs” cost more here, and we love treating our loved ones once in a while.

So, instead of forcing yourself into a formula, adjust it to your reality.

Final Thought

The 50:30:20 rule for Indian households isn’t perfect, but it’s a great start.

It helps you see the bigger picture — where your money goes, and how much could actually be saved.At the end of the day, managing money isn’t about numbers — it’s about peace of mind.

Start small, stay honest with yourself, and your money will start working harder for you.

Also Read this

- Why You Should Buy Life Insurance in Your 20s?

- 5 Situations When Health Insurance Saved Families from Financial Ruin

- How to Rebalance Your Portfolio After Recent Volatility

- Should You Stop SIP During Market Crash? Let’s Talk Honestly

- How to Start SIP Without Overthinking

- People Make Most Costly Investment Mistakes in 30s

- How To Secure Your Child’s Future?